aurora co sales tax rate 2021

The County sales tax rate is. Note that failure to collect the sales tax does not remove the retailers responsibility for payment.

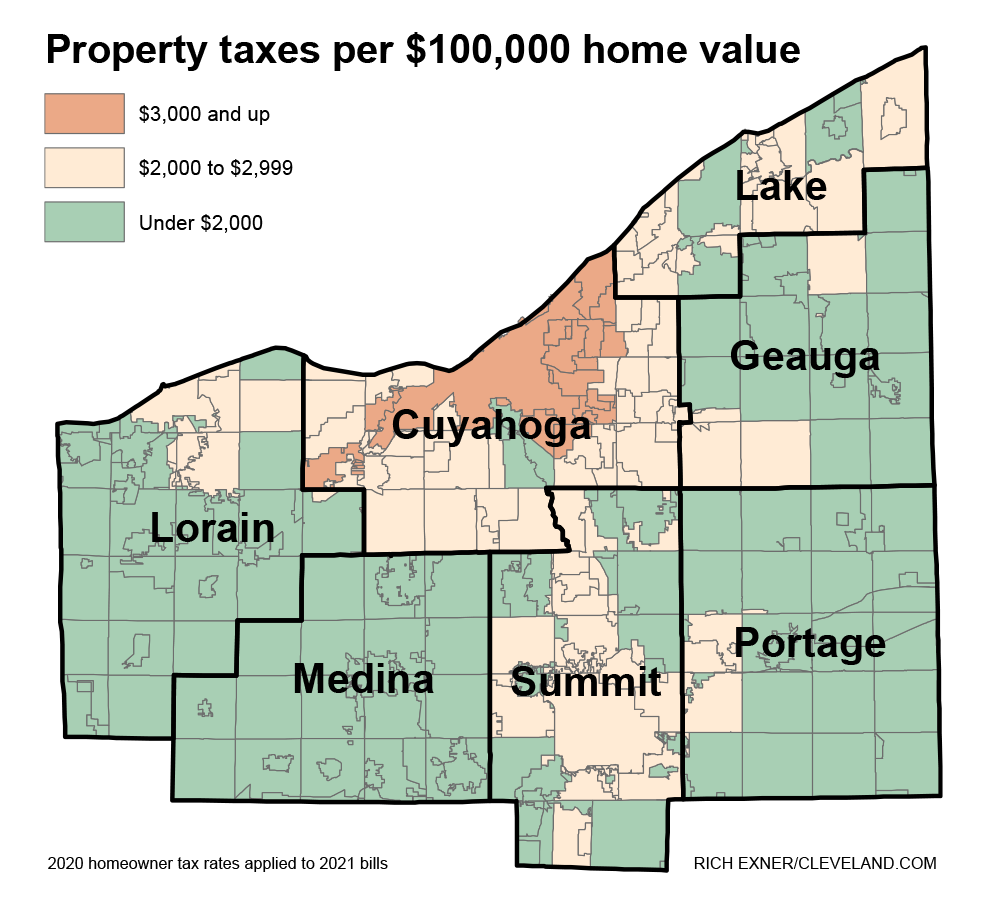

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Essex Ct Pizza Restaurants.

. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. None if net taxable sales are greater than 100000000. The average sales tax rate in Colorado is 6078.

You can print a 85 sales tax table here. The Minnesota sales tax rate is currently. 80041 - city sales and use tax rates - 2021 Aurora Arapahoe County Colorado State.

The minimum combined 2022 sales tax rate for Aurora Minnesota is. Within Aurora there are around 17 zip codes with the most populous zip code being 80013. Both Baton Rouge and New Orleans Louisiana previously had combined rates of 10 percent but these cities rates.

The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. The Aurora sales tax rate is. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

You can find more tax rates and allowances for Aurora and Colorado in the 2022 Colorado Tax Tables. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51. Bright Home Investment Blog Uncategorized aurora co sales tax rate 2021.

How Does Sales Tax in Aurora compare to the rest of Colorado. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. With local taxes the total sales tax.

The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. 31 rows The state sales tax rate in Colorado is 2900. With CD 290 000 010 025 375.

Aurora co sales tax rate 2021 aurora co sales tax rate 2021. 80017 zip code sales tax and use tax rate Aurora Arapahoe County Colorado. Aurora Co Sales Tax Rate 2021.

As far as sales tax goes the zip code with. The Aurora sales tax rate is. Opry Mills Breakfast Restaurants.

The minimum combined 2022 sales tax rate for Aurora Colorado is. Method to calculate Arapahoe County sales tax in 2021. Ad Lookup Sales Tax Rates For Free.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. 2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. For tax rates in other cities see Colorado sales taxes by city and county.

Estimated City Tax Rate. What is the sales tax rate in Aurora Colorado. Sales Tax and Use Tax Rate of Zip Code 80017 is located in Aurora City Arapahoe County.

The average cumulative sales tax rate in Aurora Colorado is 804. Soldier For Life Fort Campbell. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104.

Did South Dakota v. 80017 - County sales and use tax rates - 2021 Arapahoe County Colorado State. Sales Tax and Use Tax Rate of Zip Code 80041 is located in Aurora City Arapahoe County.

Aurora-RTD 290 100 010 025 375. Birmingham also has the highest local option sales tax rate among major cities at 6 percent with Denver Colorado 591 percent Baton Rouge Louisiana 550 percent and St. Interactive Tax Map Unlimited Use.

This includes the rates on the state county city and special levels. This Part 1 outlines criteria for determining. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

Estimated County Tax Rate. The Nebraska state sales and use tax rate is 55 055. You can print a 825 sales tax table here.

80041 zip code sales tax and use tax rate Aurora Arapahoe County Colorado. Annually if taxable sales are 4800 or less per year if. Delivery Spanish Fork Restaurants.

Income Tax Rate Indonesia. Real championship 2021 long spine board controversy. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

Aurora has parts of it located within Adams County and Arapahoe County. March 20 2021 March 20 2021 By world of cricket. 275 lower than the maximum sales tax in IL.

Louis Missouri 5454 percent close behind. Wayfair Inc affect Colorado. This is the total of state county and city sales tax rates.

Retail Sales 2 Revised August 2021 Colorado imposes a sales tax on retail sales of tangible personal property prepared food and drink and certain services as well as the furnishing of rooms and accommodations. The County sales tax rate is. This is the total of state county and city sales tax rates.

While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax. Wholesale sales are not subject to sales tax. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2.

The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. Restaurants In Matthews Nc That Deliver. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

6 rows The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax. The Colorado sales tax rate is currently. 4 rows Rate.

There is no applicable county tax. Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month.

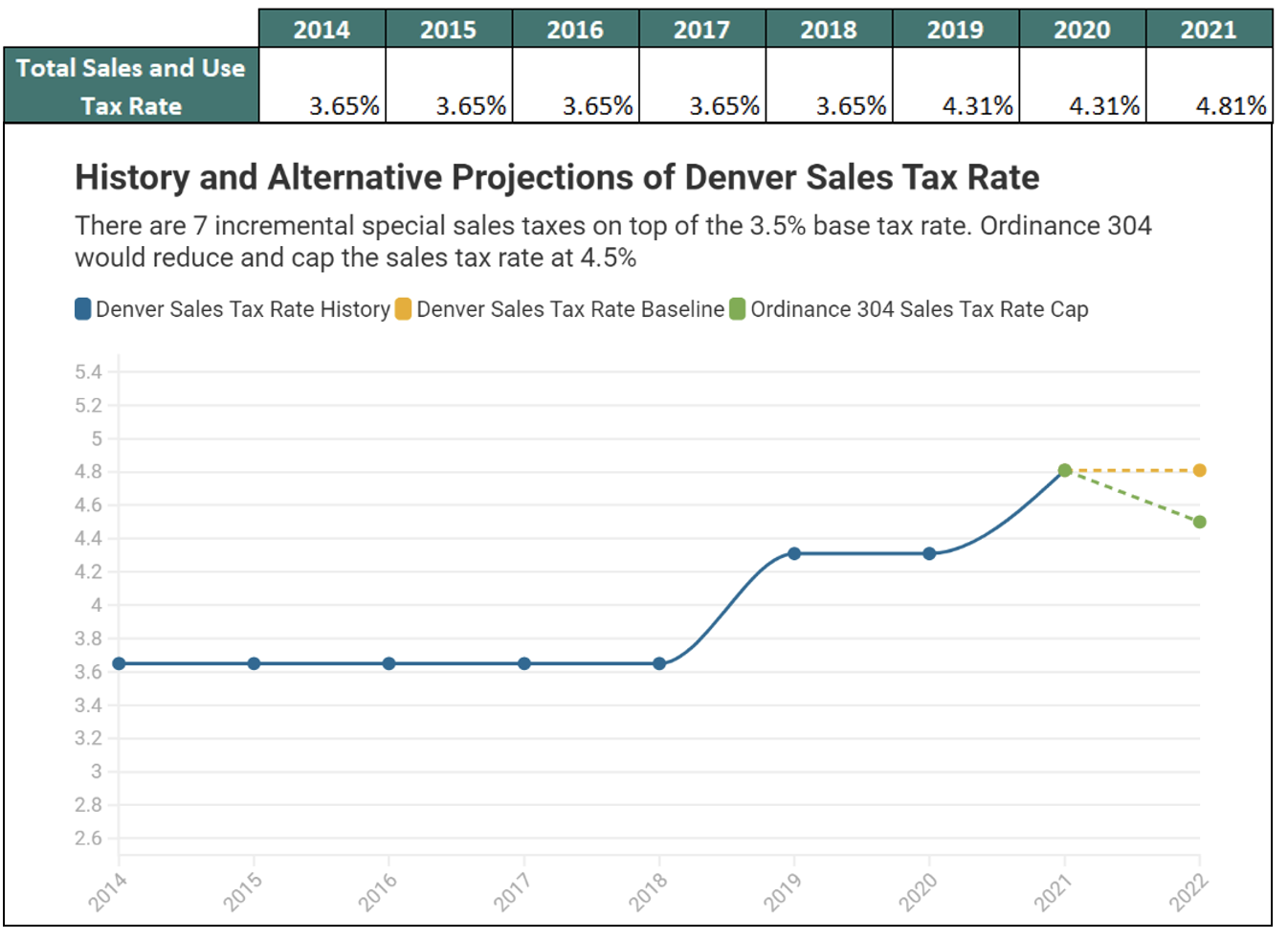

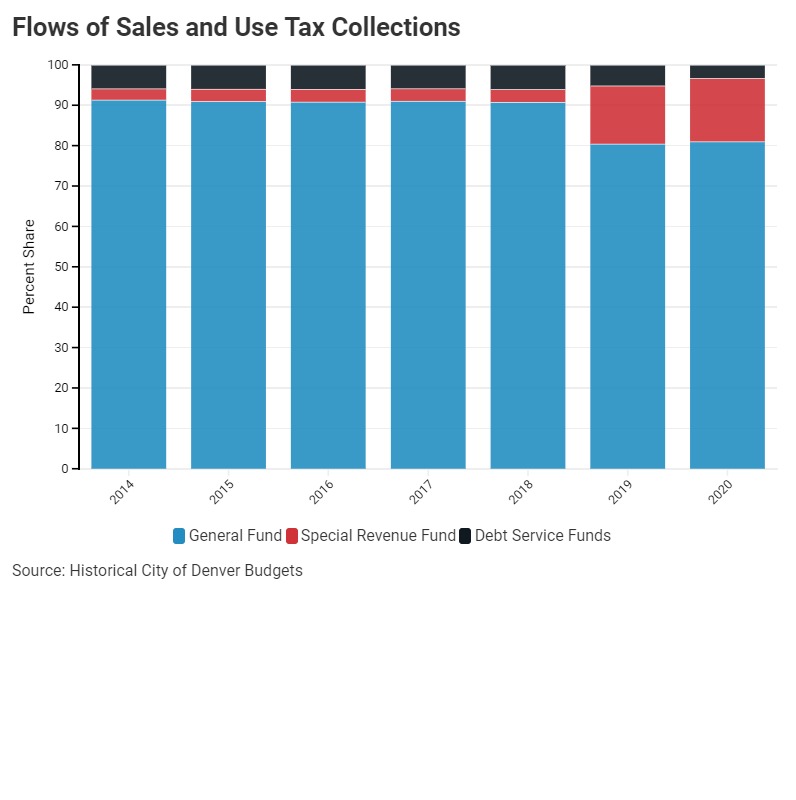

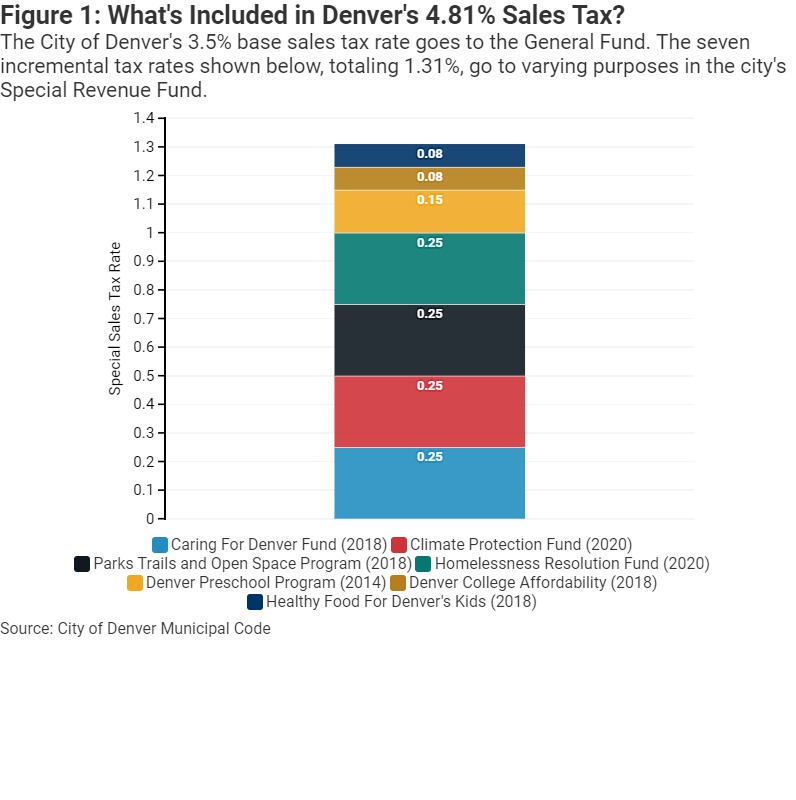

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Colorado Sales Tax Rates By City County 2022

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Kansas Sales Tax Rates By City County 2022

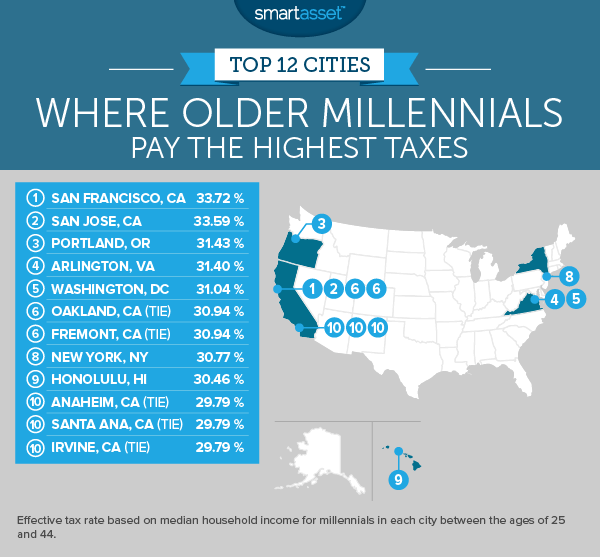

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Nebraska Sales Tax Rates By City County 2022

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation